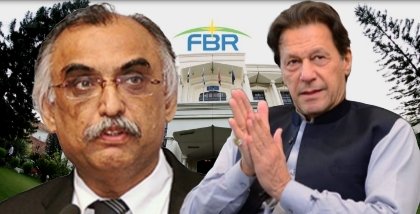

The Federal Investigation Agency’s (FIA) Anti-Corruption Circle in Karachi has registered an FIR (No. 32/2025) against former Federal Board of Revenue (FBR) Chairman Syed Muhammad Shabbar Zaidi, accusing him of criminal misconduct, abuse of authority, and unauthorised disbursement of public funds amounting to Rs 16 billion.

The case, instituted under Section 5(2) of the Prevention of Corruption Act 1947 read with Section 109 of the Pakistan Penal Code, alleges that Zaidi, while serving as Chairman FBR from 10 May 2019 to 6 January 2020, misused his position to illegally approve and facilitate the release of funds in collusion with officials of Habib Bank Limited (HBL) and the FBR.

Source-Based Enquiry Leads to Criminal Case

According to the FIR lodged by Inspector Muhammad Iqbal of the FIA’s Anti-Corruption Circle, credible information obtained during enquiry No. 91/2025 revealed that an amount of Rs 16 billion was disbursed unauthorisedly to several companies that were clients of Zaidi before he assumed charge as FBR Chairman.

The inquiry identified the following firms as recipients of the unauthorised payments:

| No | Name of Company | Amount (Rs) |

|---|---|---|

| 1 | Engro Corporation | 2 billion |

| 2 | Standard Chartered Bank | 1.5 billion |

| 3 | Habib Bank Limited | 10 billion |

| 4 | Muslim Commercial Bank | 1.5 billion |

| 5 | DG Khan Cement | 0.5 billion |

| 6 | Maple Leaf Cement | 0.7 billion |

The FIR states that Rs 8.864 billion was deposited in HBL between 29 September and 6 December 2019 in collusion with FBR staff, and that the funds were credited into Central Depository Accounts of HBL’s Treasury Division through Income Tax Refund Bonds valued at Rs 100,000 each, totalling 89,645 bonds. The funds were released against refund claims of earlier tax years — 2005, 2006, 2007, 2012, 2013, 2014, and 2017 — which the FBR authorised in favour of HBL.

Premature Encashment of Treasury Bonds

The investigation notes that the bonds, issued under Section 171A of the Income Tax Ordinance 2001, carried a three-year maturity period and a 10 percent annual return. However, in violation of the law, on 6 December 2019, and under Zaidi’s supervision, HBL management succeeded in prematurely encashing Treasury Bonds worth Rs 7.72 billion from the Government of Pakistan’s Treasury. The payment, made through cheque No. A-684435 (Book No. A6845), was credited into HBL Account No. PK69HABB0000357900018703 at HBL Plaza, I.I. Chundrigar Road, Karachi.

The FIA highlighted that this early realisation occurred “contrary to the maturity period of three years,” demonstrating misuse of authority and deliberate violation of financial rules.

Collusion with Private Audit Firm

The FIR further alleges that A.F. Ferguson & Company, a chartered-accountancy firm where Zaidi previously served as partner, was engaged by HBL since 2009 through Ms Asra Rauf, acting as chartered accountant on behalf of the firm. The FIA claims the firm’s consultancy was instrumental in facilitating the premature release of funds and that Zaidi leveraged his former professional affiliation for personal and corporate benefit.

The document explicitly mentions that “by abusing his official position, Shabbar Zaidi influenced subordinate FBR officials, authorised unlawful issuances, and created a conflict of interest that led to the unauthorised transfer of public money.”

Criminal Findings and Legal Charges

The FIR concludes that sufficient incriminating material has been found to establish that Zaidi, in active connivance with HBL management and certain FBR officials, committed offences punishable under:

- Section 5(2) of the Prevention of Corruption Act 1947 (criminal misconduct), and

- Section 109 of the Pakistan Penal Code (abetment).

The FIA has formally named four categories of accused:

- Syed Muhammad Shabbar Zaidi, former Chairman FBR (s/o Muhammad Takhawur Zaidi, CNIC No. 42301-1740521-7)

- Management of HBL

- FBR officials involved in processing and approving the illegal transactions

- Officials of A.F. Ferguson & Company

The case has been registered with the approval of competent authority, and Assistant Director Nand Lal of FIA Anti-Corruption Circle Karachi has been assigned to conduct the investigation.

Official Communication and Next Steps

Copies of the FIR have been forwarded to the Additional Director General (South), Director FIA (Headquarters), Director Karachi Zone, Deputy Director (Law), and the Assistant Director (Legal) FIA ACC Karachi, among others. The FIA stated that investigations would determine the full extent of collusion and identify additional beneficiaries.

The case is registered under the supervision of Deputy Director Muhammad Iqbal, FIA Anti-Corruption Circle, Karachi, who signed and dated the complaint 29 October 2025.